Turbulent markets upend volatility hedge funds

Simply sign up to the Hedge funds myFT Digest -- delivered directly to your inbox.

Hedge funds that bet on market volatility have turned out to be some of the biggest losers from the financial turmoil that struck in March.

Volatility hedge funds, which buy and sell derivatives to try and profit from the volatility of stocks, bonds and currencies, lost 2.4 per cent this year to July, according to the latest data from HFR. That compares with an average 0.3 per cent loss among hedge funds more broadly, and a 2.4 per cent return from the S&P 500 index.

The stumble shows how painful it can be to assume a long period of calm will continue. Betting against flare-ups in markets, or shorting volatility, as many of these funds had done, can prove costly in a shock.

“Short volatility is quite brutal when it comes to performance characteristics,” said Tindaro Siragusano, chief executive of Hamburg-based 7orca Asset Management, which manages about €400m in its Vega strategies and has lost 5.7 per cent this year in its Vega Return fund.

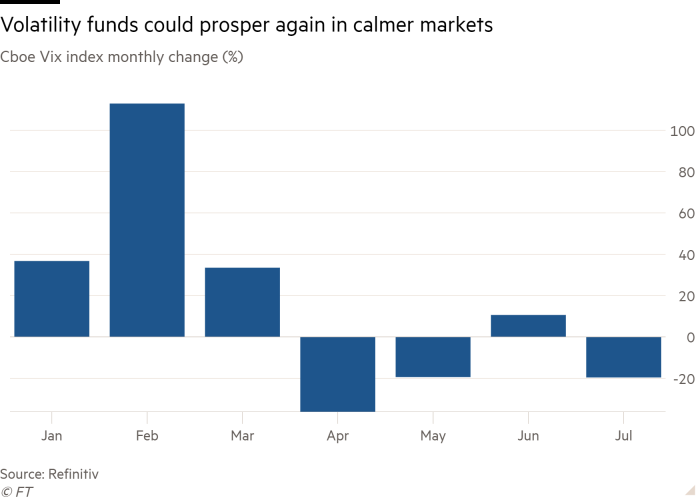

The losses come in a year when the Cboe’s Vix index of stock market volatility soared to 82.7 in mid-March, above levels seen during the 2008 financial crisis, as investors fretted over the likely economic damage caused by the pandemic. Even this summer, after stocks had rallied sharply, the Vix was still well above its long-term average.

But the funds that aim to understand these market fluctuations best have been caught off guard.

Among those to lose money is the €1.4bn Volatility Strategy run by Allianz, which fell 9.2 per cent this year to the end of July. QC Partners’ Risk Protect fund has lost more than 21 per cent after being hard hit in March. Another fund that previously ran hundreds of millions of euros, RP Gamma, shut down this year.

Many funds were struck because they adopted a strategy known as shorting volatility — betting that it will fall or remain low. Such funds sell derivative protection such as put options, which give the buyer the right to sell at a pre-determined price. They earn money by effectively writing market insurance, hoping that volatility — which helps determine options prices — will remain low and the options will expire worthless.

Many investors have been lured into taking this approach over the past decade by years of gently rising markets and mild market moves, fuelled by trillions of dollars of central bank stimulus, which have helped such funds make money.

That decision was also helped by the fact that the opposite trade — buying insurance against extreme market events — has largely been a poor performer in the past decade’s calm markets.

“If you ask people in any industry who makes money, the guy buying insurance or the guy selling insurance, it’s the guy selling insurance,” said Michael Mescher, founder of New York-based hedge fund firm Gammon Capital. That, he said, encouraged many other funds to short volatility, hitting them hard hit this year.

Short volatility has a history of blow-ups. In early 2018 Credit Suisse shut its VelocityShares Daily Inverse Vix Short Term exchange traded note, when an abrupt drop in stocks sent the Vix index soaring and the ETN collapsed in value.

Mr Siragusano describes short volatility funds’ returns as an escalator up and an elevator down, where gains are gradually earned over long periods of time while large losses are abrupt.

“Given market turbulence and spikes in volatility in more or less all major markets earlier this year, the performance of short volatility strategies has been very challenging across the board,” said a spokeswoman for Allianz Global Investors, adding that its Volatility Strategy was able to limit losses through more defensive positioning.

A spokesman for QC Partners said the firm offered “different volatility strategies with different risk profiles”.

Not all funds trading volatility have suffered. Gammon made a gross return of 600 per cent this year with more active trading of volatility, while Munich-based Quantumrock has gained 37 per cent in its Volatility Special Opportunities Program.

Since the shock of mid-March, the Vix has declined and markets have become more subdued, helping remaining funds to claw back returns. Funds have been able to sell put options at higher than normal prices but often without having to pay out on them.

Mr Siragusano said his fund was able to double the amount of money it had been making before the market turmoil from selling protection. The Allianz fund had also gained more than 5 per cent since losses incurred during the market sell-off, helped by falling volatility, said its spokeswoman.

Such funds could now be set to enjoy an extended period of low volatility. The Vix has recently fallen to just above 20, which Quincy Krosby, chief market strategist for Prudential Financial, describes as a “crucial . . . line in the sand in the market in terms of volatility” that computer-driven funds may take as a buying signal for stocks, which in turn could further reduce volatility.

“If you can break through into the 20s, you can start to see the buying then,” she said. “It suggests trading in the short term will be less volatile.”

Comments