US faces inflation threat as money supply rockets

Simply sign up to the US inflation myFT Digest -- delivered directly to your inbox.

The aggressive monetary and fiscal response to the coronavirus crisis in the US could trigger a burst of inflation that the Federal Reserve might struggle to control, according to Morgan Stanley. This, the bank said, could upend the stock market.

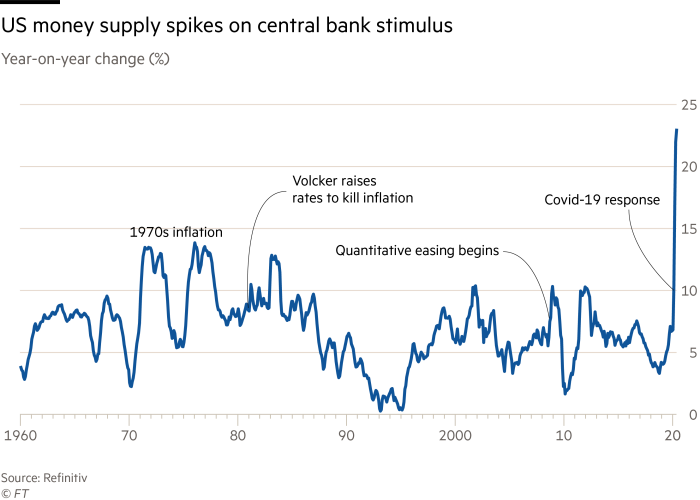

Quoting economist Milton Friedman’s dictum that “inflation is always and everywhere a monetary phenomenon”, Morgan Stanley’s chief US equity strategist Mike Wilson highlighted a surge in money circulating through the country’s economy.

The year-on-year growth in M2 — a broad measure of US money supply — has rocketed this year due to the efforts of monetary and fiscal policymakers to reduce the economic damage caused by the pandemic. Although the severity of the shock makes deflation the most likely short-term outcome, Mr Wilson argued that there is now a “greater likelihood for inflationary pressures to build”.

“While we are likely to experience big imbalances in the real economy for several more quarters, if not years, the most powerful leading indicator for inflation has already shown its hand — money supply, or M2,” said Mr Wilson.

The Fed eased monetary policy sharply after the financial crisis of 2008, and fears of faster inflation failed to materialise. However, Mr Wilson points to the far more aggressive fiscal response from the US government this year, which has ranged from massive lending programmes for stricken companies to stimulus cheques for households.

He also says banks are in much better shape than they were in 2008, making it more likely that money supply stays elevated.

For equities, faster inflation usually tends to be positive because their earnings rise with higher prices, and fixed-coupon bonds become less attractive. But there could be a shake-up of the stock market leaderboard, said Mr Wilson. “The problem may be that equity market leadership is skewed toward deflationary winners, making any sudden surges in inflation quite disruptive to portfolios,” he warned.

Comments