Foreigners join speculative China stocks frenzy

Simply sign up to the Chinese business & finance myFT Digest -- delivered directly to your inbox.

Fast foreign money is piling back into Chinese equities, with even cautious US investors placing record bets via options just in case a path develops out of the country’s property crisis and zero-Covid malaise.

The buying of Shanghai- and Shenzhen-listed equities through Hong Kong’s Stock Connect programme has climbed to more than Rmb27bn ($3.8bn) this week, according to Financial Times calculations based on exchange data.

The scheme is a key route for foreigners buying mainland securities, and the purchases have completely reversed the record foreign selling sparked last month by President Xi Jinping’s consolidation of power at the Chinese Communist party congress.

The enthusiasm has resulted in net inflows to China’s market so far this year and follows encouraging signals from Beijing, which over the weekend unveiled more support for the country’s indebted property developers.

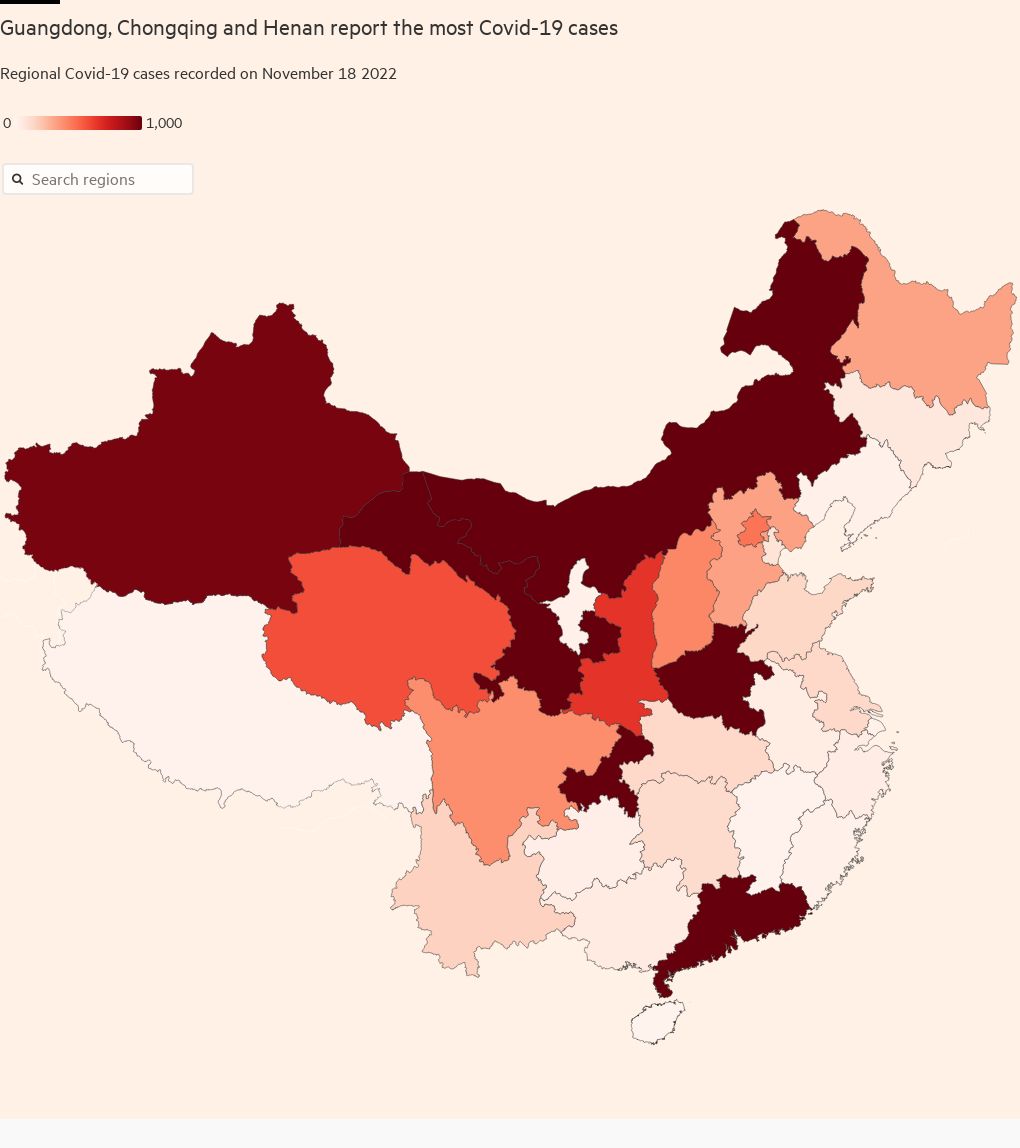

A list of measures for optimising Covid prevention and control released late last week has also stoked hopes that the end is in sight for Xi’s economically disruptive zero-Covid policy.

A Shanghai-based director of one Chinese brokerage cautioned, however, that the bulk of inflows so far appeared to have come from “more speculative” investors such as hedge funds rather than long-only asset managers, whose participation would signal more meaningful enthusiasm for Chinese securities.

“[Long-only investors] like what they’re seeing, but they need to see more detail on these policies . . . to really turn it round,” the director said.

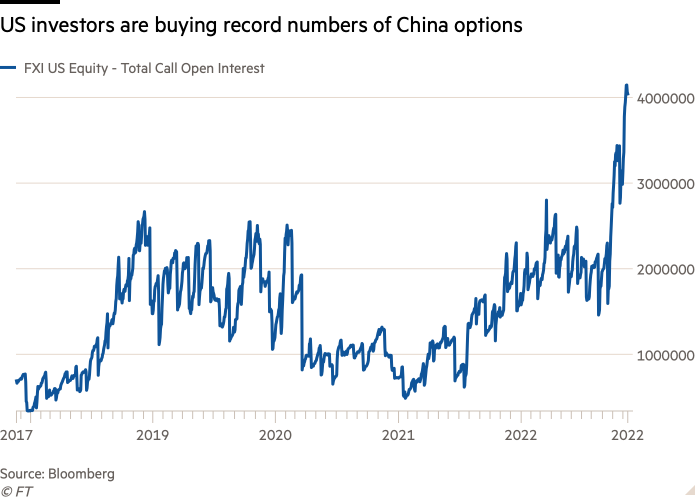

In the US, investors have bought call options to avoid missing out if a reopening did produce a sustained rally.

The number of outstanding call contracts for the most liquid US-listed options tracking China’s stock market has smashed records in recent weeks.

Calls give investors the right but not the obligation to buy assets at a set price at a later date. The most liquid of these contracts are based on BlackRock’s China Large Cap ETF, a passive fund that tracks the FTSE China 50 index. The number of outstanding calls has risen 35 per cent this month and doubled since the start of September.

Amy Wu Silverman, equity derivatives strategist at RBC Capital Markets, said many investors were “intentionally underinvested in Asia right now because it’s very hard to analyse the geopolitical and political risks . . . but a tail risk is Xi Jinping can turn around and say, ‘Covid is over’. This [options buying] appears to be one of the more attractive ways to keep exposure.”

Foreigners initially sat out a nascent rally for the benchmark CSI 300 index, which has now jumped almost 9 per cent from its late October nadir.

“There’s some interest coming back,” said Pruksa Iamthongthong, senior investment director of Asia Dragon Trust at Abrdn, “but I wouldn’t say that you can call it a sustainable rally yet, and a lot will depend on execution of the policies that have been announced.”

Additional reporting by Cheng Leng in Hong Kong

Comments