Bitcoin ETF rules leave UK investors out of global craze

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

The hotly anticipated launch of a bitcoin ETF in the US leaves the UK out of step with some other major markets in maintaining its blockade on retail access to exchange-traded crypto funds.

US regulators follow Canada and European nations such as Germany and Sweden in giving the green light to exchange-traded products linked to cryptocurrencies, which supporters claim are a safer way for retail investors to access volatile crypto markets.

But access to this type of fund for UK retail investors remains blocked by the Financial Conduct Authority (FCA), which has said it would not authorise a fund that has exposure to crypto until it is satisfied with integrity of the underlying market.

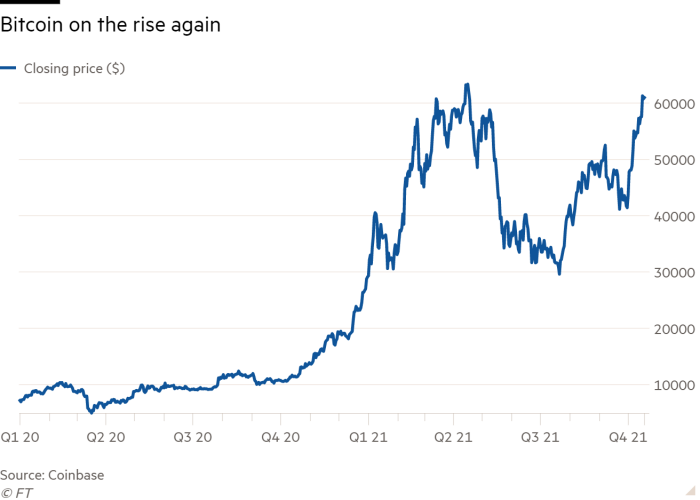

The FCA has repeatedly voiced concerns about cryptocurrencies including their extreme volatility and the lack of a solid basis for their value.

The UK restrictions on these funds, which have attracted billions of dollars of investment in other jurisdictions, highlights the debate over whether the FCA’s reluctance to approve regulated vehicles for crypto investment results in retail investors turning to riskier avenues to access popular digital assets.

“The UK has been, from an investment product perspective, slower than most jurisdictions,” said Jason Guthrie, head of digital assets at WisdomTree, which offers exchange traded crypto products in Europe and has applied to launch funds in the US.

The UK’s strict approach to crypto regulation has not deflated some investors’ enthusiasm for digital assets. Although the FCA has repeatedly warned of the risks of crypto investments and banned digital asset derivatives, UK residents can still buy cryptocurrencies directly on online exchanges such as Coinbase and Gemini.

Some exchanges have established a UK footprint and achieved different levels of regulatory approval to operate. But offshore exchanges also offer their online service widely in the UK with little regulatory oversight.

More than 4 per cent of adults in the UK, or 2.3m people, own a cryptocurrency, according to the latest FCA research. Stocks linked to crypto have also proven popular with retail buyers.

Many retail investors want to see regulated crypto vehicles on the market. A survey of UK investors aged under 30, a cohort which has flocked to crypto investments, conducted by Opinium Research for WisdomTree, found that six in 10 young UK investors think there are not enough regulated entities providing access to cryptocurrencies.

Almost 50 exchange-traded products linked to crypto assets are on offer globally, with combined assets of $14bn, according to data from TrackInsight. The largest Canadian fund, the Purpose Bitcoin ETF listed in Toronto, has grown to $1.7bn since its launch in February.

The ProShares Bitcoin Strategy ETF, which launched in New York on Tuesday, drew significant early demand from investors.

But despite the appetite for these funds, the FCA remains opposed to letting UK retail investors join in on the global craze.

“Significant price volatility, combined with the inherent difficulties of valuing cryptoassets reliably, places retail consumers at a high risk of suffering losses from trading,” FCA executive director of strategy & competition Sheldon Mills said this year when the regulator banned crypto derivatives.

The watchdog’s cautious approach has been endorsed by some market players. Hargreaves Lansdown, the UK’s largest investing platform, said it would be wary of offering crypto funds even if the FCA allowed one in the future, given the risks involved.

Laith Khalaf, head of investment analysis at AJ Bell, said exchange-traded crypto products “tend to be extremely complex and come with risks which most investors don’t have the tools or information to evaluate”.

One tricky question surrounds how funds take exposure to bitcoin or other crypto coins. Some ETFs are backed by actual bitcoin, held by a custodian. But there are a range of other structures, including funds that deal in crypto futures.

The new US ProShares fund falls into the latter camp, using bitcoin futures to mimic the price of the crypto token. This set-up has been favoured by US regulators because futures trade on the regulated Chicago Mercantile Exchange, but critics say it can incur extra costs for investors.

A Canadian ETF tracking bitcoin futures almost froze in May during an extreme market swing.

Defenders of crypto funds argue that ETFs are still safer than other ways of accessing crypto markets, given that the funds are run by mainstream players and customers don’t have to hold the crypto assets themselves. Some fear the FCA’s ban pushes investors down riskier paths.

“A lot of people are still going to the unregulated internet space,” said Guthrie. “I think there’s a role for actual service providers to come with actual products, and be on the hook for what they deliver.”

Click here to visit the ETF Hub

Comments