Climate change: how China moved from leader to laggard

Simply sign up to the Renewable energy myFT Digest -- delivered directly to your inbox.

The smoggy city of Baoding is known for two things: donkey burgers, and solar panels. An industrial centre just south of Beijing — 45 minutes via high-speed rail — the city’s high-tech zone styles itself as “Power Valley” because it is home to so many solar manufacturers.

But for Vincent Yu, deputy general manager at Yingli Solar, one of the first renewables companies to set up in the city, business has been difficult lately. “These last two years, there has been a lot of pressure. The subsidies for solar projects have fallen,” Mr Yu says. New solar installations in China — running at 53 gigawatts in 2017 when demand peaked — will be about 40 per cent lower this year, he estimates.

The photographs in his office show Yingli in its glory days a decade ago. Sales were surging and the company spent millions sponsoring the 2010 and 2014 football World Cup tournaments. Yingli was the world’s largest solar-panel maker in 2012 and 2013, exporting all over the globe and celebrated in China as a national champion. Its huge factory campus in Baoding still nods to that status, with a spacious museum dedicated to the company’s history as a solar pioneer.

Today Yingli is insolvent. It has been defaulting on debt payments since 2016, and in 2018 it was kicked off the New York Stock Exchange because its market capitalisation had sunk below the minimum $50m threshold. Although Yingli still makes solar panels, its factories operate at a loss and the most valuable asset it has left is the land underneath them. Some question how Yingli is still operating. But analysts believe the political connections of its founder may have helped stave off creditors.

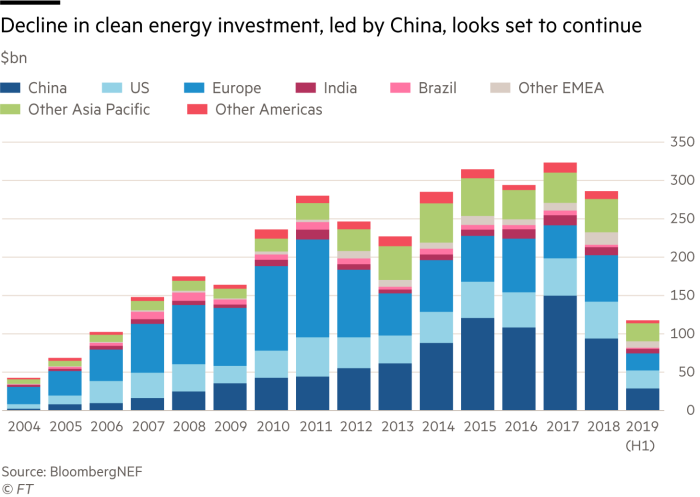

The company is the highest profile casualty of a change in policy that is being felt across the renewable energy sector in a country once celebrated as the world’s clean energy champion. Chinese investment in clean energy is plummeting — down from $76bn during the first half of 2017, to $29bn during the first half of this year.

For the annual UN climate talks, starting next Monday, that is alarming.

Concerns over the impact of climate change have never been higher. But the gap between what countries should be doing, and what they are actually doing — pumping rising levels of carbon dioxide into the air — has never been greater. With the US withdrawing from the Paris climate accord, an increasing amount of attention is on China.

The country is both the greenest in the world, but also the most polluting. It has more wind and solar power than anybody else, yet it is also the world’s biggest builder of new coal plants. Last year, its emissions hit a record high, accounting for more than half of the global increase in energy-related CO2 emissions in 2018, according to the International Energy Agency. This year, Chinese emissions are expected to grow about 3 per cent from 2018.

“Everything is at stake for the planet, because the Chinese economy is so much bigger than any other,” says Adair Turner, chair of the Energy Transitions Commission. “Even the whole of Europe is considerably less than Chinese emissions.”

He points to China’s current pledge, that its CO2 emissions will peak by 2030, and says it is nowhere near ambitious enough. “Let’s be clear, if that was all China ever did, then we are on the path to climate disaster,” says Lord Turner, who is lobbying for China to consider a target of net zero emissions by 2050. “That is true of all the [countries that have made pledges under the Paris accord] . . . everyone has always known there would have to be very significant improvements, to get us anywhere close to 2C.”

The Paris climate accord, of which China is a signatory, pledges to limit global warming to well below 2C. But that goal looks increasingly out of reach. The world is on track for 3C of global warming by the end of this century, if current trends continue. That would mean higher sea levels of as much as 1m, threatening more than 600m people in low-lying and coastal areas, according to a recent report from the UN’s Intergovernmental Panel on Climate Change.

The climate pact is under attack from many sides, and the US is withdrawing from the agreement entirely, on President Donald Trump’s orders. Fraying multilateralism has further eviscerated the climate accord, which lacks any enforcement mechanism. China — distracted by a slowing economy, the US trade war and protests in Hong Kong — is not the only reason why the planet is on course for devastating climate change, but it is near the top of the list.

“The general momentum on climate and environment issues has been declining [in China],” says Li Shuo, senior global policy adviser at Greenpeace. Climate change has become a lower priority for Beijing. “There is less space for the green agenda,” he says.

China’s investment in renewable energy fell 39 per cent in the first half of this year, compared with the same period in 2018, according to data from Bloomberg New Energy Finance. Beijing yanked subsidies for solar panel projects in the middle of last year, and is shrinking those for wind, causing an abrupt shift.

“This is probably a low point,” says Li Junfeng, a senior renewable energy

policymaker and head of the National Centre for Climate Change Strategy Research, part of the government planning ministry. “The new policy is not in place yet, and the old policy [of subsidies] has been stopped.”

Five years ago, when the economy was growing robustly, Beijing saw stronger environmental policies as core to its economic transformation away from energy-intensive heavy industry. Today, with the economy growing at its slowest pace since the early 1990s, that has changed.

“The highest political priority in China is trying to stabilise the economy,” says Kevin Tu, an energy economist who previously led the China desk at the IEA. “Anything else, including environmental protection, especially climate change, will have to make some room for these political priorities.”

On paper, China’s climate targets have not changed: Beijing has pledged that its carbon dioxide emissions will peak by 2030, and that it will draw 20 per cent of its primary energy from non-fossil sources by that same date. Yet that promise would allow China to keep increasing its emissions for the next decade, with devastating implications for the planet. Its investments in the Belt and Road Initiative, under which state banks have earmarked more than $30bn to build coal-fired power plants in other countries, is also adding to global emissions.

China’s participation in the Paris climate pact in 2015 was heralded as a great victory by activists. Convincing Beijing to set climate targets was a top priority for the Obama administration. But baked into the negotiations was an expectation that China would achieve its emissions target much earlier than 2030. Next year will be crucial, as countries that signed the Paris accord are supposed to submit enhanced targets — but the mood in Beijing makes a tougher climate goal less likely for China.

Mr Li says deteriorating relations between the US and China — along with the unrest in Hong Kong — have helped fuel a growing nationalist sentiment and a broader anger at the west.

One of the targets of this nationalist ire has been Greta Thunberg, the Swedish teenage activist who is revered as a climate hero in some parts of the world. “Many netizens see [Greta] as representing the general liberal western agenda,” says Mr Li. “There is this larger perspective that the west is ganging up against China.”

At the same time, coal appears to be again in the ascendant with Li Keqiang, China’s premier, last month identifying it as a priority area. China remains the world’s biggest producer. Many see this as part of a growing focus on energy security in Beijing, a result of Chinese leaders being spooked by deteriorating relations with the west . “Energy security anxiety is a blessing for the coal [sector] in China,” says Mr Tu.

Policymakers are also focused on keeping the cost of power cheap to help stimulate the economy, so from January the price of electricity from coal-fired power plants, which is centrally regulated, will be allowed to fluctuate, and is expected to fall.

These factors have compounded the pain for the renewable energy industry. After benefiting from generous subsidies for more than a decade, Beijing axed solar subsidies without warning last year. The payments due have created a deficit of around Rmb200bn ($28bn) in the renewable energy development fund that was paying out the subsidies.

Frank Haugwitz, founder of Asia Europe Clean Energy (Solar) Advisory in Hong Kong, says the subsidies contributed to a solar surge that exceeded the government’s expectations, triggering the sudden cut.

The dice are now loaded in coal’s favour. The new policies for renewable energy are focused on grid parity — only building wind and solar projects that can compete with the price of coal. Yet with coal power prices dropping, and a glut of new coal-fired power stations coming online, it may be challenging for wind and solar to compete. In the wind industry, there has been a rush of projects this year as developers try to capture the last of the subsidies.

The diplomatic pressure on China to improve its climate targets has been played out in public. During a state visit from Emmanuel Macron, the French president, earlier this month, both sides issued a joint declaration, vowing that the Paris climate deal was “irreversible”, and promising new climate targets aimed at the middle of the century.

Chinese policymakers such as Li Junfeng say the pressure is misplaced, as China is likely to exceed existing climate targets, even if it does not officially adopt new goals. “Now that the US has withdrawn from the Paris agreement, the entire global response to climate change is shifting,” he says. “We have to be realistic . . . There’s no point in being in a rush.”

He also points out that China has achieved, and far surpassed, most of its previous climate targets. A pledge to cut carbon intensity — the amount of carbon produced per unit of GDP — by between 40 and 50 per cent by 2020, compared with 2005 levels, was achieved three years early. It also overachieved on its targets for solar installations, although this runaway growth led to the subsidy deficit.

For many years, action on climate change was the one area that Beijing and western capitals could usually agree on. Even the most hawkish western politician would hold up China’s climate record as an example to be praised.

But that may be changing. “It is going to sour for sure, if China doesn’t move in the right direction, quickly enough,” says Todd Stern, the chief US negotiator for the Paris agreement, who adds there is simply “less leeway” now in terms of global emissions. “We can’t possibly do what we need to do, unless China is doing quite a bit.”

“We are sort of entering a new world now . . . It is not just a sense of urgency, it is the math. Do the math, and you will see whether we are doing enough,” says Mr Stern. “The Paris agreement is going to rise and fall, on the level of political will in constituent countries. That has always been true.

“The fault is that there is a lack of political will in virtually every country, compared to what there needs to be.”

Solar eclipsed: a pioneering panel-maker retrenches

Stepping on to the Yingli campus in Baoding is like stepping back in time. Employees wear a dark navy jumpsuit with the Yingli sunburst logo on one shoulder and a Chinese flag on the other, giving the place a distinctly communal feel. In front of a large assembly yard, a big stage is decorated in honour of the recent 70th anniversary of the founding of the People’s Republic of China, plastered with slogans such as “remember your mission” and “help each other”.

The company’s problems began at least five years ago, as mounting debt levels combined with plummeting panel prices. Its dire financial situation became evident in May 2016, when Yingli failed to meet a $270m loan payment. Discussions with debtholders, the largest of which is China Development Bank, have since failed to reach conclusion. Shareholders fear the worst: Yingli’s shares on the pink sheets — the over-the-counter market for companies not listed on a major exchange — are trading at just 15 cents a share. The cut in government subsidies for solar projects has only compounded the challenges.

Miao Liansheng, the founder who started his career in the army before becoming an entrepreneur, was once ranked among China’s richest individuals. Mr Miao lives on the Yingli campus, and employees say that he still makes daily appearances to chat with workers.

But today there are fewer workers than there used to be. Many of the factory production lines are quiet. It’s not clear if some are under maintenance, or if they have simply been idled. The company once had around 20,000 employees, but that has fallen to just over 6,000, according to deputy general manager Vincent Yu. This year it will produce panels with capacity of 2.5GW-3.5GW, he says, equivalent to about 3 per cent of global demand.

The Yingli museum shows that the company was, in many ways, a pioneer. It boasted the first automatic soldering equipment in China in 2005 and the first automatic module production line in 2007. But its equipment quickly became outdated, allowing newer entrants to undercut them.

Starting a decade ago, China’s state support for solar panel manufacturers led to overcapacity and vicious price wars. This pushed down the price of solar panels — to the benefit of the rest of the world — but meant that margins were razor-thin, or negative, for panel manufacturers in China.

Letters in response to this article:

China’s future energy mix will include nuclear / From Wendy Legrand, London SW1P, UK

China’s main concern is air pollution, not emissions / From Dr Robin Russell-Jones, Marlow, Bucks, UK

Comments