Cannabis investors bet on regulatory softening

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Rahul Bhushan, co-founder of the company behind the Rize Medical Cannabis and Life Sciences Ucits ETF, can be a master of understatement. “It wasn’t the easiest product to construct,” he says of the exchange traded fund, which launched in February 2020.

He and the team at RizeETF had been watching the legal cannabis sector since 2016, after becoming convinced of the potential returns from pharmaceutical applications if regulators acquiesced and allowed investment in the industry.

RizeETF listed its fund on the London Stock Exchange, Deutsche Börse Xetra and Six Swiss Exchange after negotiating a maze of European legislation. In some cases, laws permit citizens to invest in overseas cannabis businesses provided those companies’ operations are legal in their country of domicile. But there are variations: in the UK, for instance, the law states that overseas companies’ business activities have to be legal in the UK as well.

However, investors seem to be betting that authorities in an increasing numbers of countries will soften the rules around cannabis.

“People are using these products basically to gamble on government regulatory decisions,” says Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, in explaining the stampede for cannabis ETFs.

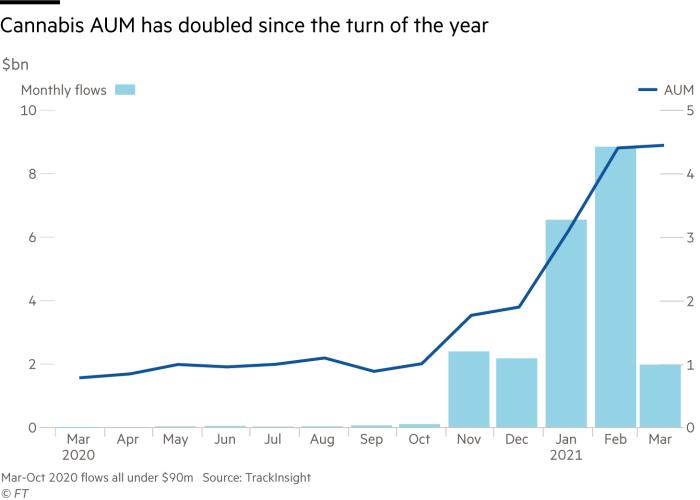

Assets under management in these funds swelled from $792m at the end of March last year to $4.4bn at the end of March 2021, according to data from TrackInsight.

Rize, along with its competitors in the ETF space, has been able to capture some of these inflows, which have been driven by several macro regulatory developments.

In November, the European Court of Justice ruled that cannabidiol — an extract of the cannabis plant acknowledged to have medicinal benefits — was not a narcotic no matter what part of the plant was used for its extraction. A month later, the UN Commission on Narcotic Drugs removed cannabis for medicinal purposes from a list of dangerous drugs following a World Health Organization recommendation.

But the most recent fillip was a high-profile decision by New York, in March, to legalise cannabis for both recreational and medicinal use.

Now, the next hurdle is funding. Dylan Kennett, senior associate in the London corporate team of law firm DLA Piper and co-chair of its global cannabis practice, which acts as counsel for cannabis businesses and investors, is awaiting the outcome of the US Secure and Fair Enforcement Banking Act.

The bill passed the House of Representatives on April 19 this year and, if it comes into law, it will make it easier for the wider banking industry to support legal cannabis companies in the US, enabling investment to flood into the industry.

“Ultimately, the real question is whether federal legalisation in the US takes place under this administration,” Kennett says. At the moment, recreational cannabis remains illegal under US federal laws that govern the whole country.

Yet, with money pouring into cannabis-focused ETFs, concerns are growing that there is too much capital chasing too few companies.

“The liquidity promised by the ETF structure means investments can be pulled out on a whim,” says Morningstar’s Lamont. “Should one of these ETFs suffer large outflows, it may struggle to find buyers for large holdings in small companies.”

He adds that there is a temptation for ETFs that have exposure to themes with high growth potential, such as cannabis, to invest in smaller, less liquid stocks.

“However, the increased trading costs will be passed on to the ETF investor through larger spreads and, where the underlying [asset] can’t be traded at any price, tracking error versus the underlying benchmark will increase,” Lamont warns.

ETF providers are conscious of this concentration risk. At its last rebalancing, the HANetf Medical Cannabis and Wellness ETF (CBDX) increased its number of holdings from 19 to 34. It launched in January last year with only 16 constituents.

“That growth in holdings is going to happen a lot,” says Hector McNeil, co-chief executive of HANetf.

But other risks remain: McNeil cautions that constituent companies could branch into parts of the cannabis business that then renders them illegal for investors in particular jurisdictions to own.

Weeks after it launched CBDX, for example, HANetf announced it had removed Namaste Technologies from its holdings. Namaste held a 49 per cent interest in another company that gained a licence to produce cannabis-infused chocolate bars and drink mixes which, in some countries, would be against the law. Moving from permitted to illegal status will become more common for some investors as companies owned by their ETF move into the recreational business as domestic laws ease.

Given the regulatory and liquidity risks, Lamont says he would not recommend cannabis ETFs to retail investors — though he notes they are probably of great interest to exactly that audience.

“The potential market is clearly enormous globally,” he says, but adds: “From a retail perspective it’s to be emphasised that this is a risky investment.”

Comments