How to reclaim shareholder power and reshape companies

Simply sign up to the Investments myFT Digest -- delivered directly to your inbox.

If you are interested in Covid conspiracy theories you will have heard no end of claims about the nasty capitalist (or worse) motives of the big pharmaceutical companies.

They have no interest in your health. They are nothing but profit machines, dedicated to churning out medications and vaccines of dubious efficacy and possible high toxicity with a view to making money and then some more money at your expense.

Worse, they are aided and abetted by their “overlords,” the world’s giant fund management groups, BlackRock, State Street and Vanguard. These groups control big pharma — and being profit-seeking machines themselves — have just as little interest in the future of your health as Pfizer and co.

They don’t care whether Covid is real or not. They don’t care whether the vaccine works or not — perhaps they even know it doesn’t. They just want shots in arms and bonuses in bank accounts.

This is mostly (I hope) pretty unreasonable. But like all good conspiracy theories, it has a kernel of truth: the big fund management companies do, should they choose to use it, have effective control over not just the big pharmaceutical companies, but most listed companies in the world.

The end owners of all shares are of course people. Look to the UK and you will see that almost everyone (in work at least) now owns shares in our listed companies.

Over 3m people annually invest in stocks and shares Individual Savings Accounts (Isas). Two million have opened self-invested personal pensions (Sipps), inside which they tend to hold shares in one form or another.

Anyone employed and earning over £10,000 will have been auto-enrolled into a pension scheme by their employer (you can opt out, but very few people do). And all these pension schemes hold shares.

Most developed countries will have a similar system, although the UK’s is particularly good in the way it auto-enrols the majority of the workforce — and fairly generously too. So, one way or another, we are technically part owners of the corporate world.

You might think that would mean that we would have a degree of control over the way these companies behave. After all, every share we own comes with a vote over company decisions; everything from executive pay to who gets to be on the board of directors and any major shifts in corporate strategies.

Voting for change

Those who aren’t mad for capitalism often talk about the wonders of common ownership — but while socialism promises this, shareholder capitalism actually offers it in real life: if you work in the UK you automatically become an owner of the system in which you work.

In theory, you could use that ownership to help force change. Fed up with companies letting themselves be sold abroad? You can vote against it.

Not convinced that an oil company should spend billions becoming a renewable energy company instead of just winding down and paying out the cash? You can vote against it. Angry with a mining company that has caused pollution? You can vote against its directors keeping their jobs.

The behaviour of companies operating inside a system of shareholder capitalism is — technically at least — in our gift. I say “technically” because, as ever, the devil is in the details.

When the limited company was first invented, you knew where you were at with your shares. You had a certificate noting your ownership and rights and you exercised them as you liked (or sold the certificate on as you liked). As recently as 1963, more than half the shares in the UK stock market were held like this — by individuals. Those individuals had paper certificates and were regularly contacted directly by the company’s executives (with annual reports on performance and the like).

These were the days of individual shareholder activists such as the Gilbert brothers, who, at their peak, owned stakes in 1,500 companies and spent their lives going around the annual general meetings (AGMs), haranguing management about things they didn’t like. One of them kept a clown’s horn with him so he could blow it every time a chief executive said something he considered silly, which was quite often.

Those days are gone. Now only 13.5 per cent of UK shares are individually owned and, for the few who have them, there is no paper, and mostly no annual report.

We hold our shares either digitally on investment platforms — such as Hargreaves Lansdown and Interactive Investor in the UK. We need to be very proactive if we want to use our votes at the AGMs of the companies we invest in or via the middle man of the pension and fund manager, as we generally buy funds not shares.

As the percentage of shares owned by individuals has fallen, so that held by the big institutions has risen.

In 1960, big institutions in the US owned around a third of the shares on Wall Street. By 1980, it was 60 per cent. Now it is more like 80 per cent. In 1957, the combination of pension funds, insurance companies and investment funds owned a mere 18 per cent of the shares in issue in the UK. That has steadily risen — to 60 per cent in 1994 and up to 80 per cent now, based on OECD and other public data. Not all of these institutions are UK-based, of course — over 50 per cent of UK shares are held by investors from the rest of the world in some form or another.

The fact remains that we don’t directly control much of the game any more. Fund managers do. And they control a little more every year: global assets under management have risen from around $35tn at the start of the millennium to over $100tn now.

Some 41 per cent of all equities globally are owned by institutions. This makes sense. Investing is hard. It takes time and energy. Contracting it out to professionals is simple — particularly if you have barely even clocked that you have been auto-enrolled into a pension savings scheme (as you may have been in the UK, New Zealand, Canada, Chile, Germany, the US and Poland).

The investment overlords

This brings me to the “overlords.” This is an industry increasingly dominated by its own giants. In the US, the three largest asset management firms, BlackRock, Vanguard and State Street, together manage around $20tn of assets.

That is one-third of all the assets managed worldwide; they control 80 per cent of all the assets under management in the US. Hello, oligopoly.

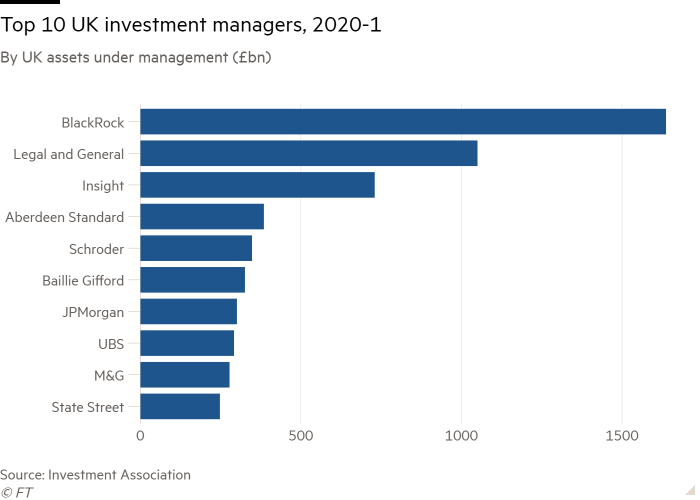

These US giants have long since landed in the UK too: BlackRock is now the largest asset manager in the UK. This represents real and possibly scary change.

Even 30 years ago, it would have been unusual for any one firm to hold more than 1 per cent of the shares in a big organisation. Today in the US, one of the Big Three is the top shareholder in 495 of the companies in the S&P 500, the index for 500 of the biggest companies in the US. All in all, they control what the pressure group Common Wealth calls (quite rightly) a “staggering” 20 per cent of the average company in the index. If things keep going in the same direction that number could soon be 40 per cent.

Given the general lack of interest about voting among other holders, in terms of voting rights that’s more than enough clout to demand that a company does pretty much anything the Big Three fancy. And they do, it seems, fancy a lot of stuff.

This is not only going on in the US. In the UK the share of the average FTSE 100 company held by the top 10 investors, all institutions, rose from 36 per cent in 2011 to 40 per cent in 2020.

That doesn’t sound like much of a shift. But look inside and you see US managers growing their stakes significantly: the Big Three held an average of 7 per cent of the average FTSE 100 company 10 years ago. Now it is 12 per cent.

Today, BlackRock and Vanguard control over 10 per cent of more than two-thirds of the 100 largest listed UK companies. BlackRock is the number one shareholder in 41 of those firms. Vanguard is a top 10 shareholder in 98 of them.

Concentrated capital

However you interpret the numbers, around a third of the invested capital in the world is run by 100 asset managers, according to Common Wealth in a report called “Goliath and Goliath”. You will see the problem.

We might own shares, which is a very good thing. But instead of taking on the responsibility of choosing, buying and managing shares, we have increasingly given our money to fund managers and asked them to do it for us.

We don’t hold the shares ourselves. We hold units in funds that hold the shares. There is some good news among all this, of course. Back in 1963 only 3 per cent of the population were shareholders, or about 2m people. Now at least 75 per cent of employees are.

Nonetheless, the result is that we have effectively delegated our voting rights to the nation’s fund managers — and in particular to pension fund managers. We might remain the ultimate owners, but we have no power — so instead of making us part of the show, our shares are effectively nothing but a ticket allowing us to watch it — if we can be bothered.

Fund managers are a smallish group of very well-paid, mostly group-thinking men, as female fund managers remain in the minority. They speak for us to the managers of the companies we own and vote for us. And those fund managers very rarely ask us what we want them to say or vote.

That needs to change — and can change. The stock market is in one sense now hugely democratic — we all own it — and hugely undemocratic — only very few of us get a say on how it is run.

The technology exists to allow fund managers to hand the votes on our shares back to us. It should be simple: we all tell the fund managers how we want to vote, they aggregate and vote accordingly. Not many managers are ready to do this — though some are beginning to ask their clients what they want (L&G and Aviva are ahead of the game).

As more do the same we can start to make sure we get the capitalism and the — buzzword alert — “stewardship” we want (whatever that turns out to be).

When it comes to Pfizer, my guess is that if we had a voice as shareholders we’d mostly want the directors to know that we’d be pretty keen to keep the vaccines coming, but perhaps were it possible, we’d like to head off any social media concerns about them by seeing the data from their trials earlier rather than later.

The brilliance of free markets

There is a view that capitalism has failed — and that it needs somehow to be totally transformed. My desk is littered with books explaining the miseries caused by capitalism; some offering radical solutions for saving or reimagining it.

It’s mostly unnecessary nonsense. First, capitalism has demonstrably not failed. It is instead a stunning success — as you would expect given that it works naturally with the human instinct for improvement and accumulation.

The facts speak for themselves: in the early 1990s some 35 per cent of the world’s population lived in extreme poverty. It’s now well under 10 per cent — and, although the pandemic has stalled things a little, the number continues to fall.

If you find yourself questioning the brilliance of free markets, think of how western economies reacted to the pandemic. Aside from the few days when supermarkets ran out of loo paper and pasta, there were no real shortages of anything.

You might have felt the world had shut down as you were furloughed or worked from home for a year, but it did not. The wheels kept turning — and companies adapted to keep their shows on the road. Logistics firms expanded, restaurants switched to home delivery and physical retailers moved online.

Across the world, the rate at which new businesses started up soared. There’s a message here about the power of innovation in free markets — and however you cut it, there is no doubt that capitalism passed the test of 2020 with flying colours (unlike governments but that’s another story).

Corporate capitalism is far from perfect. Big — and small — companies often behave badly. But as a system it works brilliantly. What we need to do is re-engage with it, not reimagine it.

That means taking our responsibilities as owners back from the giant fund management companies (which is perfectly possible), criticising the companies we have stakes in if necessary but supporting them as they produce products and services that help us.

We also need to remind ourselves that there isn’t really a “them” and an “us”. We are all customers, employees or suppliers in one way or another — and we are also mostly owners. The great would-be reformers of capitalism like to make a clear distinction between stakeholder and shareholder, but in the main, the two are one and the same.

If we can remind ourselves that the majority are one way or another owners and that we have the power to act (by using their votes as shareholders), we can reconnect big business and ordinary people while forcing better behaviour on the corporate world. Oh, and save capitalism along the way.

This article is based on Merryn Somerset Webb’s book, Share Power: How ordinary people can change the way that capitalism works — and make money too, £9.99 Short Books (January 2022)

Letter in response to this column:

Wielding power with your stocks can be expensive / From Keith Wright, Manchester, UK

Comments