Retail investors keep buying the dip in ETFs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Amateur traders have driven a record-breaking pace of inflows into exchange traded funds this year, suggesting that beyond their eye-catching forays into quirky individual stocks, they are also playing a role in cushioning broader declines in indices.

US-listed equity ETFs, which typically allow investors to gain or offload exposure to baskets of stocks, drew in $249bn in 2020. But so far this year, they have attracted a record $305bn — in large part from retail investors, according to research firm CFRA.

“Investors are not panicking when a sell-off takes place and most of the new money being deployed is for broad market ETFs that are building blocks for portfolios,” said Todd Rosenbluth, CFRA’s head of ETF and mutual fund research.

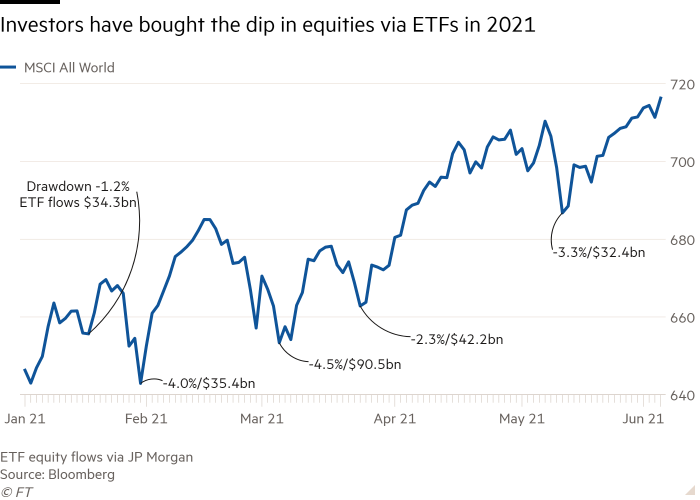

ETF inflows help explain the limited pullbacks in US stock indices since last November. Typically, a 5 per cent equity market decline occurs three times a year, but none has occurred in the past seven months. Bank of America also notes that the past 15 months have not brought a single 10 per cent correction to the S&P 500 index, usually an event that crops up at least once a year.

“Whenever there is an immediate drawdown in equities, retail comes in immediately to buy the dip,” said Eric Liu, an analyst at Vanda Research. “People default to ETFs as a way to buy the dip. And recently retail has been buying more ETFs than any other segment of the equity population.”

Investment advisers and brokerages have supported the flows into ETFs, where retail investors accounted for 70 per cent of sector flows so far this year, said analysts at JPMorgan in a research note. “The ETF flow has represented a wall of money backstopping each dip in equity markets so far this year,” and “the greater the dip, the higher the equity ETF flow”, said the bank.

The question is whether this bullish sentiment will survive when tested. Markets have rallied hard, and they now sit at record price levels and high valuations. In the coming months, inflation fears are likely to intensify alongside pressures on companies from rising wage and input costs.

Signals from the Federal Reserve that it may reduce its pace of bond purchases presents another challenge for asset prices that have boomed as investors moved out of debt markets, where low interest rates eroded the yield paid out on bonds.

Retail money market funds still have plenty of ammunition for buying any larger equity price pullbacks, with holdings at all-time highs above $1tn. That money is essentially earning zero interest, and provides a hefty source of dry powder.

“If you’re wondering whether retail investors will ‘buy the dip’ if and when we see further market volatility, all we can say with certainty is that they absolutely have the cash to do so,” said Nicholas Colas, co-founder of DataTrek Research.

Click here to visit the ETF Hub

Comments