The other side of Chinese investment in Africa

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

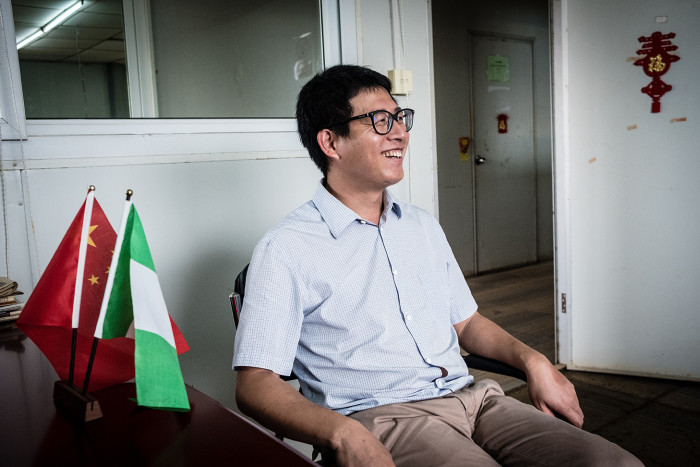

Wilson Wu has big plans for the free trade zone he manages in Igbesa, a scruffy town in Ogun State, some 60km from the frenzy of Lagos, Nigeria’s huge commercial capital.

Casting his gaze over what is today a small cluster of industrial warehouses surrounded by mud roads and bush, Mr Wu can see an altogether brighter future. “We will have a five-star hotel, a golf club, a Walmart,” he says in a well-rehearsed pitch. “It will be like Dubai.”

An electrical engineer by profession, Mr Wu’s journey to west Africa followed an assignment as a young man in Myanmar, where he worked for Power Construction Corporation of China, a state-owned group, upgrading the electricity grid. In 2011, hungry for more adventure, he packed his bags and headed for Nigeria, where, still barely 30 years old, he was tapped up to manage the Ogun State free trade zone, a private-public project in which the local government provides the land and Chinese enterprise the capital.

Mr Wu is one of hundreds of thousands of Chinese citizens — a common estimate is about 1m — who have ventured to Africa over the past two decades to seek their fortune. Like many who have ended up there, he sees in Africa’s raw energy and ambition an echo of the forces that were unleashed by Deng Xiaoping’s reforms of 1978.

“It is like the China of the 1970s and 1980s when you could open a business and maybe earn a fortune,” he enthuses. “Those kind of fortunes are not possible in China today.”

People like Mr Wu have been persuaded to test their ambition in far-flung corners of the world by tougher business conditions in China, where rising labour costs, industrial overcapacity and more stringent environmental standards are taking their toll. While many entrepreneurs have looked closer to home, to countries such as Cambodia, others have struck out to Africa.

It is China’s massive infrastructure projects, including dams, railways, ports and telecommunications networks, that capture most attention. Between 2000 and 2014, the stock of Chinese investment in Africa went from 2 per cent of US levels to 55 per cent. McKinsey estimates that, at the current breakneck pace, China will surpass US levels within a decade.

Washington has belatedly woken up to China’s growing presence which is transforming both the physical and diplomatic landscape of Africa. In December John Bolton, President Donald Trump’s national security adviser, accused China of using “bribes, opaque agreements and the strategic use of debt to hold states in Africa captive to Beijing’s wishes and demands”.

China in Nigeria

10,000

Chinese companies operating in Africa, including 920 in Nigeria and 861 in Zambia (McKinsey)

$500bn

Value of African industrial output handled by Chinese businesses — about 12% of the total (McKinsey)

9%

Manufacturing’s contribution to Nigerian gross domestic product in 2017 (World Bank)

Yet large companies such as Huawei, and big state-affiliated companies, such as China Bridge and Road, are not the only Chinese actors reshaping the continent. What officials in Washington may not fully understand is that thousands of hardscrabble entrepreneurs like Mr Wu, involved in everything from retail and factories to farming, are having just as big an impact.

Irene Yuan Sun, an associate partner at McKinsey and author of a book on Chinese investment in Africa, says the influence is particularly strong in manufacturing.

“Chinese manufacturing investment is the best hope that Africa has to industrialise in this generation,” she says. “Chinese involvement in Africa is not just about state-driven efforts. A just as large, if not larger, component is these private enterprises, which are more job-intensive, which localise quicker and which have a much larger economic and social impact.”

When Mr Wu first came to Ogun, there was virtually nothing in place. The state’s free trade zone he manages is majority-owned by Guangdong New South Group, a private Chinese conglomerate with interests in everything from medicine to coal mining. Mr Wu’s team was given a 2.24 sq km patch of land and told to get on with it.

Nigeria, like countries across Africa, has a huge infrastructure deficit. It lacks reliable power, water and all-weather roads. New South Group has had to build almost everything from scratch, including natural gas-powered generators and yet-to-be paved roads connecting the zone to Lagos and beyond.

“It is like managing a country,” Mr Wu says of the zone, which is designed to be an enclave of efficiency and stability in Nigeria’s notoriously unpredictable business environment. “We have our own customs, our own police, our own operations. The government of Nigeria provided the land. We used all our own money to build everything else.”

After seven years in operation, the free trade zone has 50 registered companies, including two ceramic manufacturers producing tiles and plates, a steel-pipe plant and factories making everything from furniture to tomato sauce. There is a printing business, a plastic recycling company and another specialising in construction materials.

For Mr Wu, the next 15 to 20 years will see a massive expansion to 10,000 companies, 200 times the number today. “We will have eight different industrial sectors,” he says. “We will have different zones for electronics, for tiles, construction. In the future, we will have a university for research and development.”

“Nigeria has the conditions to be a factory of the world,” says Zhou Pingjian, China’s ambassador to Nigeria. “It should become the factory of the world.”

If that is Nigeria’s putative future, for now, Mr Wu and thousands of Chinese entrepreneurs in the country like him have to contend with the present. Manufacturing made up just 9 per cent of gross domestic product in 2017, according to the World Bank, and President Muhammadu Buhari — who was re-elected in February — has complained that Nigeria imports everything from toothpicks to tomato purée.

Like other countries in Africa, Nigeria’s manufacturing ecosystem has withered since the 1980s, partly thanks to a poorly executed industrial policy that saw the state lavish billions on white elephant projects. An irony of Chinese entrepreneurs setting up factories in the country — and in other parts of Africa, such as Ethiopia and Rwanda — is that the import of cheap Chinese goods was another factor in destroying local production. Nigeria has also been hit by the oil exporter curse, which pushed up the exchange rate, making it cheaper to import finished goods than produce them. The country’s once thriving textile industry is today a pale shadow of itself.

Because of a shortage of all but the most basic raw materials, most Chinese factories in Nigeria are limited to final assembly. They rely on imported parts and inputs, which means they need to access scarce foreign currency and coax supplies past sometimes obstructive port officials.

“The currency volatility is just too high,” says Wing Liao, the founder of Winghan, a Chinese furniture brand with a factory in Ogun state. “When there is profit, a fluctuation in currency exchange rates can wipe it all out.”

To get hold of foreign exchange, Chinese entrepreneurs have had to get creative. Many say they buy Nigerian raw materials, such as timber and marble, which they then export to buyers in China or Europe in exchange for Chinese renminbi. Rings of Chinese money-changers specialise in matching those needing foreign currency with willing Chinese buyers of Nigerian imports.

“Once the ship leaves port and has its papers signed by the port authorities, you can collect your money,” says Ban Yushi, manager of a Beijing-based mining company.

Lack of inputs and scarcity of foreign exchange are just two of the obstacles faced by Chinese entrepreneurs. Rightly or wrongly, they complain about the skill levels of Nigerian workers, the product of a state education system that has deteriorated over recent decades.

“The machines are often too difficult to operate for local employees,” says Chen Donghua, a shoe factory manager at the Lee Group, a manufacturer owned by Hong Kong entrepreneurs. “But because local labour is cheap they can still package them by hand.” Mr Chen’s company provides training to employees who, he says, in practice have little above an elementary school education.

Chinese businessmen also have to negotiate past Nigeria’s bureaucratic gatekeepers for permits and licences. “To visit a government official here, you best have around $6,000 to $10,000 with you,” says Mr Ban, the miner. “Otherwise, forget about getting an appointment.”

There are cultural obstacles too. Across the continent, Africans accuse Chinese workers of refusing to integrate. Many of them choose to work in unmarked offices and dormitories, away from the prying eyes of authorities and potential competitors. They are accused of bringing in their own labour, though companies have quickly learnt they need to provide local employment if they want to stay in business.

From the perspective of Chinese workers, thousands of miles from home in an unfamiliar environment, life can also be tough. “This place is very lonely,” says Peng Hong, who manages a medicine manufacturing company in Lagos and Kano, which employs around 350 Nigerians and 45 Chinese.

Mr Peng arrived in west Africa in 2005 from landlocked Hubei province, in central China, where he says, “life is too hard”. Life has been hard in Nigeria too. “We import most of our food and cook for our Chinese employees,” he says. On the weekends, Mr Peng organises company outings for his mostly male employees to the supermarket or to Lagos’ only Chinese-style karaoke bar.

Like many arrivals, Mr Peng has had to battle. “We had to clear all the trees, drill our water wells, rig our own electrical transmission lines,” he says. “When I first came here, we had to light candles after 4pm because there was no stable electricity. We could not sleep because of the heat, so we would sleep outside in the courtyard.”

Chinese entrepreneurs complain too that the authorities talk big but often fail to deliver. The expansion of Ogun’s free trade zone, for example, is being held up by the state’s inability, or unwillingness, to buy up land from local chiefs, Chinese executives say.

Chinese views about their host communities can be blunt. “Nigeria has the most thieves in the world,” says Thomas Liu, who runs the medicine company where Mr Peng works, using the sort of uncompromising language that grates from Accra to Kinshasa. “You have to avoid being tricked.”

Yet despite their myriad complaints, they say fortunes beckon. “If I could give advice to my former self, it would be ‘move faster,’” says Kent Chan, manager of Grand Shine Construction Materials. He set up his first factory in Nigeria in 2015. “I actually wanted to come in 2014 but then Ebola broke out. If I had come that year, I think business would have been even better.”

The influx is by no means limited to Nigeria. McKinsey estimates there are more than 10,000 Chinese businesses operating in Africa, 90 per cent of them privately owned.

Drawing on the “flying geese” concept of Japanese economist Kaname Akamatsu, researchers at the China-Africa Research Initiative at Johns Hopkins School of Advanced International Studies argue that, as costs in China rise, manufacturing will gradually shift to regions like Africa. Between 2000 and 2015, Chinese companies registered more than 1,000 African manufacturing proposals with the commerce ministry in glass, recycled steel, ceramics, gypsum board, textiles, dying, tanneries and shoe factories to name but a few.

Chinese companies, including garment makers in Tanzania and Lesotho, relocated not only because of cheaper labour costs. They were also drawn by the prospect of tariff free exports to the US under the African Growth and Opportunity Act, and to the EU under the Everything But Arms agreement. In Ethiopia, Huajian from China and New Wing from Hong Kong were attracted by the country’s high-grade leather, the researchers at SAIS found.

Once companies gain a foothold in one country, many seek to expand. New South Group aims to open 10 industrial zones like the one in Ogun across Africa, starting with a 700- acre facility near the Kenyan city of Eldoret that began business in February. It plans to open in Ghana and Angola, where, as in Nigeria, reliance on oil exports has devastated local manufacturing.

In Nigeria, as in much of Africa, Chinese investment provokes suspicion as well as praise, but for the most part officials welcome the attention. Jonathan Coker, Nigeria’s former ambassador to Beijing, says western warnings about Chinese investments are hypocritical.

“Diplomats say we will become slaves of China. This is the propaganda of the west,” he says. Instead, he adds, Nigeria has much to learn. “China is 10 times the size of Nigeria’s population but they have developed a system that can take care of their people. These are the examples we want to adapt.”

Not all Chinese entrepreneurs have a positive impact. In Madagascar, they are blamed for illegal exports of rosewood and zebu, a type of cattle. Chinese demand for African wildlife also fuels poaching from Zambia to Mozambique.

Nor does Ms Sun see the arrival of Chinese entrepreneurs as a magic bullet. The author accepts that, along with the promise of factories and jobs, they may bring environmental degradation and friction with African communities.

“But they are extremely entrepreneurial and they are doing profoundly important things,” she says. “Not all good, not all bad. But we have to pay attention.”

Comments