FT 401: complete list of the top US retirement advisers

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The FT 401 aims to provide a list of elite professionals who specialise in advising US employers on their defined contribution plans. The advisers were assessed according to quantifiable data, using the following methodology.

Scroll down for the full list.

The Financial Times and Ignites Research, the FT’s sister company, contacted large US brokerages, independent advisers and other wealth managers to identify qualified applicants.

Our research partner, Broadridge Financial Solutions, provided data that helped to identify advisers specialising in serving companies sponsoring DC plans, including 401(k) plans and other DC accounts.

Applicants were required to advise on at least $75m in DC plan assets (an increase from last year’s $50m) and have at least 20 per cent of their client assets in DC plans.

The qualifying advisers completed a questionnaire about the nature of their practice, and we added that information to our own research.

The formula the FT uses to grade advisers is based on six broad factors and calculates a numeric score for each adviser.

The factors were:

- DC assets under management (AUM). This signals experience and success in managing money in 401(k) programmes and other DC plans.

- Growth rate in DC plan business. Measured by changes in both DC plan clients and assets, growth is a proxy for performance, client retention and ability to draw new clients.

- Specialisation in the DC business. This is measured by what percentage of the overall assets managed by the adviser are in DC plans and how that concentration has changed.

- Experience advising on DC plans. This tracks years spent managing DC plan assets through different economic and market environments.

- Industry certifications. These show technical knowledge that is particularly important in the complicated DC plan industry.

- Compliance record. A string of client complaints can signal potential problems.

Among the top factors in our scoring, DC plan assets accounted for roughly 50 to 60 per cent of each adviser’s score on average.

Another 15 to 25 per cent of the score derived from the growth in the adviser’s DC business (as measured in both DC assets and number of DC plans being advised).

We present the FT 401 as a list rather than a ranking, because each adviser takes different approaches to their practices and so ranking these advisers from 1 to 401 would be misleading.

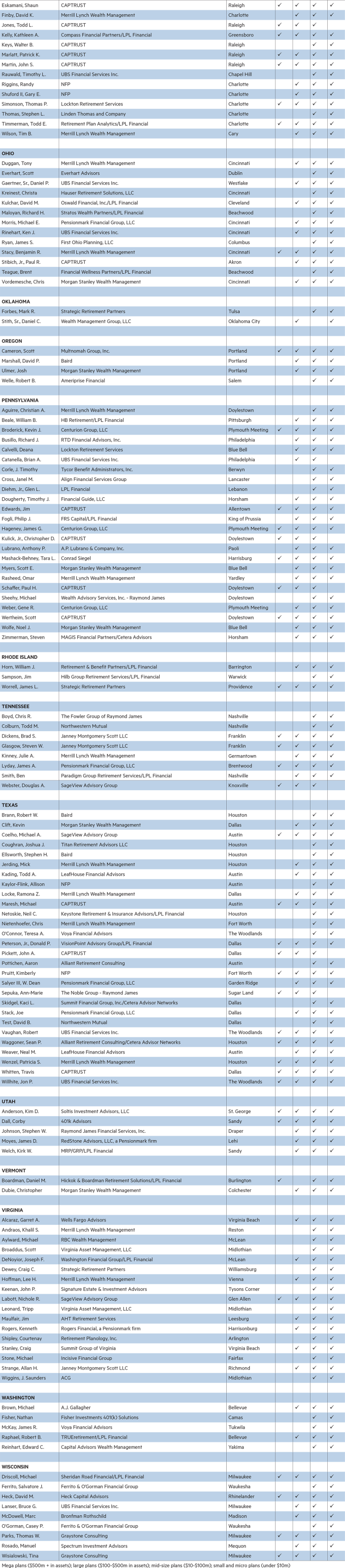

FT 401

Top retirement advisers in the US listed alphabetically by state

Comments