Capital shortfalls likely to emerge from unprecedented ECB probe

Simply sign up to the European companies myFT Digest -- delivered directly to your inbox.

The probe of the euro area banking sector being led by the European Central Bank has been billed as a once-and-for-all opportunity to kill the lingering crisis of confidence that is hampering lending in the region.

But amid huge uncertainty over the likely results at the end of next month, observers of the process caution that the outcome may prove less decisive than some have hoped.

The initial answers thrown up by the exercise in late October will leave grey areas and scope for haggling, and the full repercussions of the so-called Asset Quality Review which has lain at the heart of the exercise may not become clear for many months. With only weeks to go before the results are disclosed, there is no clear consensus on what the outcome will be.

A poll by Goldman Sachs of institutional investors shows nine banks that are expected to have capital shortfalls, led by Banca Monte dei Paschi di Siena, Commerzbank and Millennium BCP, leading to €51bn of funds in capital raisings expected on average.

Fewer investors now expect significant capital holes to be exposed, however, with a sharp decline in the number of respondents expecting more than €100bn to be raised overall.

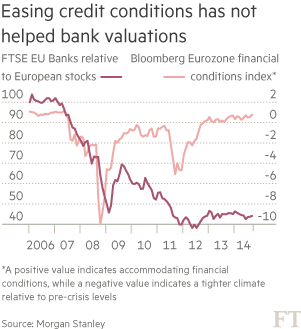

Nick Anderson, a banking analyst at Berenberg, warns that there is market complacency around the ECB’s health check – despite what he believes to be deep-rooted issues in the European banking system.

“The overwhelming consensus is that the tests are a non-event and there will be few problems,” he says. But he adds: “I’m convinced there are large scale hidden loan losses.”

The health checks are the most complex and far-reaching such exercise in euro area history, covering 85 per cent of all banking assets in the region and probing more than 130 lenders.

The exercise, comprising the AQR and a set of stress tests, is an attempt to scotch the region’s reputation for avoiding problems with its banking sector. It will be critical to the reputation of the ECB’s new Single Supervisory Mechanism, which takes over regulation of major banks in November.

Europe is widely seen to have botched previous banking turnaround exercises, including stress tests led by the European Banking Authority in 2011, which were attacked as being too soft.

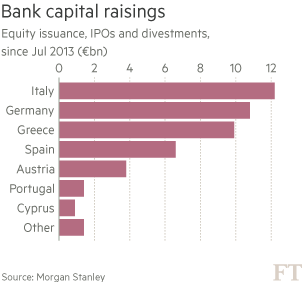

Huw van Steenis, banking analyst at Morgan Stanley, predicts the “vast majority” of AQR adjustments are already known by the banks and calculates that €47bn of capital has been raised since July 2013 ahead of the tests.

Good news for Greece

Greek banks are set to receive a welcome boost from a change in the law allowing them to count deferred tax assets towards their regulatory capital, following similar moves by Italy, Spain and Portugal

See below

Regulators argue that the current process has already had benefits, forcing banks in Italy and elsewhere to raise capital rather than awaiting marching orders in October.

“Those markets which already had external stress tests will show fewer surprises and capital raising only for economic deterioration in the periphery since the last tests,” he says.

Figures revealing banks’ capital shortfalls are expected towards the end of October. They will not be the final word, however, as they will only take account of some of the remedial measures banks have taken to strengthen their finances in recent months.

Crucially, the assessment of holes in banks’ balance sheets will only be correct to the end of 2013. While details of any capital raising in 2014 – such as the €8bn capital raising by Deutsche Bank in May – will be made clear in disclosures by the authorities, other vaguer balance sheet exercises that took place in 2014 will not.

These could include the sales of portfolios or business units or plans to cut costs. The sale price of such deals or details of internal plans will not always have been made public, leaving it up to analysts and investors to work out the likely impact on their balance sheet.

Banks will take their two weeks’ grace period – where they have to come up with plans to plug any capital hole – to make the best case they can as to why existing or planned cuts could count towards painting their finances in a better light.

The details of these plans, which will be presented to the ECB, will not be made public, according to a person familiar with the exercise. Kinner Lakhani, an analyst at Citi, estimates an initial shortfall of €28bn across the sector that will fall to just €12bn once balance sheet repairs in 2014 are taken into account.

The process will trigger a further, longer-term set of implications. Nicolas Véron, of the Peterson Institute think-tank, expects intensive discussions between banks and regulators following the AQR findings, with the result that some lenders end up modifying accounting and valuation practices. This could have a significant, longer-term impact on regulatory capital – and many investors are not ready for it, he argues.

“This is, in effect, the bad news to come – the impact of the Comprehensive Assessment will be felt long after October,” says Mr Véron. “This makes it more difficult to assess the impact of the AQR on the day of the result. There could be a long sequence of recapitalisations and restructurings that last beyond the initial six to nine months following the October announcement.”

The ECB has further unfinished business in the area of risk-weighted assets calculations. At present, there can be differences of up to 100 basis points on the same portfolio depending on how the RWA is calculated in various jurisdictions, according to a report by consultancy group Oliver Wyman for Spanish banks. While the ECB will try to get all lenders to eventually fall in line, this is a process that could take months or even years, according to one person.

Banks have complained bitterly about the heavy burden of complying with the AQR and stress test. But they are only at the start of a long journey as a brand new euro area regulator takes the helm in Frankfurt.

Goldman Sachs identifies five banks likely to come up short

The FT’s banking editor Martin Arnold takes a closer look at the top five banks identified in a survey by Goldman Sachs that are expected to have capital shortfalls in the context of the ECB’s probe.

1. Monte dei Paschi di Siena

The Siena-based bank raised €5bn from issuing shares to investors in June. This helped to avert the threat of nationalisation and shored up its balance sheet by repaying €3bn of the €4.1bn in state aid that the lender has received.

The bank’s widely respected top team of chairman Alessandro Profumo and chief executive Fabrizio Viola have been cutting jobs and selling assets in an attempt to reverse nine consecutive quarters of losses. But uncertainty still hangs over Italy’s third-largest bank by assets, which is the world’s oldest lender having been founded 542 years ago.

2. Commerzbank

Under chief executive Martin Blessing, the German lender has been busy selling off assets in its so-called bad bank, including commercial real estate, shipping and corporate finance. This cleaning up of its balance sheet continued over the summer with the sale of a €4.4bn portfolio of Spanish property loans.

The bank, which returned to profit this year, plans to cut non-core assets to €67bn by 2016 from more than €100bn last year. The German government still owns 17 per cent of Commerzbank, making it the subject of regular takeover speculation. Its most prized asset is Mittelstand bank, one of the biggest lenders to Germany’s successful exporters.

3. Millennium BCP

Portugal’s largest listed bank completed a €2.25bn share issue in June that was used to pay back state loans injected into the lender during the country’s three-year international bailout.

Shares in BCP have almost doubled in the past year, in contrast to its main Portuguese rival Banco Espírito Santo, which collapsed amid a scandal at its family holding company. BCP has been bolstering its balance sheet by selling assets, including a stake in a Greek bank and its non-life insurance arm. The bank, however, is still in the red and reported a net loss of €62m for the first half of the year.

4. Banco Popolare

Italy’s fourth-largest bank by assets announced a rights issue of €1.5bn in January as it sought to boost its capital. Alongside the share issue, the Verona-based lender said it expected to post a net loss of €600m for this year.

Having abandoned plans to sell a majority stake in its bad bank, which holds €3.2bn of the lender’s non-performing loans, it said in August that it would seek to sell it in small chunks, starting with a €300m-€400m portfolio of soured loans. Pier Francesco Saviotti, chief executive, said in June that it would look at merger opportunities once the European stress tests and AQR are completed.

5. Piraeus Bank

Greece’s biggest bank by assets broke the country’s five-year hiatus from market financing in March by issuing a €500m senior unsecured bond and launching a separate €1.75bn share offering. This showed that investors were ready to lend again to banks in the region’s recession-battered periphery and prompted its rival Greek banks to follow suit.

Piraeus has the highest proportion of non-performing loans of the big four Greek banks and made a pre-tax loss of €114m in the first half of the year.

Piraeus acquired the Greek operations of two Cypriot banks last year and is two-thirds owned by the country’s bank bailout fund.

Legal changes set to help Greek banks in stress tests

Greek banks are set to receive a welcome boost from a change in the law allowing them to count deferred tax assets towards their regulatory capital, following similar moves by Italy, Spain and Portugal, write Martin Arnold and Kerin Hope.

The change to the law in Greece would allow the country’s four big banks to convert their combined €13.4bn of deferred tax assets into tax credits, boosting their capital just in time for this year’s stress tests by the European Central Bank.

A finance ministry official said legislation on the move was being prepared and would be presented to parliament for approval later this month. “We want to ensure that Greece’s financial sector is treated equally with its peers,” the official said.

Deferred tax assets arise when a bank makes losses or incurs provisions that it can later offset against its tax bill. Under the new Basel III regime, such assets will progressively no longer count as regulatory capital. Tax credits, in contrast, will still count towards a bank’s capital cushion under Basel III rules.

Analysts at Citigroup said the change would add as much as €10bn to the combined common equity tier one ratios – a crucial measure of financial strength – of the four big Greek lenders: Piraeus Bank, National Bank of Greece, Alpha Bank and Eurobank.

However, bankers said they would enjoy a smaller benefit in the stress tests, which assess their capital over the 2014-2016 timeframe, rather than under the fully loaded basis of the Basel III regime’s final implementation in 2019.

That means the banks would enjoy a combined €2bn boost to their capital ratio in the stress test – equivalent to 6 per cent of their combined market capitalisation. Citi said it would be “a useful buffer to mitigate any shortfalls in the ECB’s stress test”.

One banker said this would be “a small net positive” but “not a game-changer”. The benefit would be partly diluted, he said, because the banks would have to add the tax credits to their risk-weighted assets.

It would bring Greece in line with its rivals in Italy, the first European country to change the treatment of deferred tax assets in 2011, as well as Spain and Portugal, which both followed suit in the past year.

The four big Greek banks were rescued by the country’s bailout fund after the eurozone debt crisis. But they have rebounded recently by returning to the capital markets to raise a combined €8.4bn from investors.

Yet only National Bank of Greece has returned to profitability and analysts think they are still among the banks most at risk of falling short of the levels required in the ECB’s stress tests and asset quality review.

The International Monetary Fund has signalled the Greek banks could need an additional €6bn to meet Basel III capital requirements. Non-performing loans in the sector have risen this year from 35 per cent to more than 40 per cent and are projected to peak early next year, marking the highest percentage of any eurozone country apart from Cyprus.

Back to top

Comments