Property bubble is ‘major risk to China’

Simply sign up to the Property sector myFT Digest -- delivered directly to your inbox.

On desolate salt flats on the far outskirts of China’s sixth-largest city, dozens of enormous half-built skyscrapers stand as a monument to the excess and optimism of the Chinese real estate market.

As physical manifestations of China’s property bubble go, few examples can beat this effort to replicate Wall Street in a wasteland 40km outside Tianjin and 150km from the capital Beijing.

Blueprints for the Yujiapu Financial District are intentionally modelled on Manhattan’s skyline, complete with an ersatz Rockefeller Center and twin office towers that look uncannily similar to the ones destroyed on September 11 2001.

Officials in charge of the project boast that when Yujiapu is eventually finished in 2019 it will be one-third larger than the City of London and more than three times the size of New York’s financial district, at least in terms of surface area.

But after years of soaring prices and frantic construction across the entire country, China’s real estate bubble is showing serious signs of strain and this project’s fate is now in question.

The country’s property market is barely 15 years old and nobody has ever experienced a real crash because, before the late 1990s, most urban residents in post-Communist China were still provided housing by their “work unit”.

Chinese banks started issuing home loans in 1997 and as recently as 1994 a central bank official charged with translating an American financial document had to look to Taiwan for a translation since no dictionary in Beijing included a Chinese word for “mortgage”.

Even before the global financial crisis of 2008 many were already warning of a property bubble in China, prompting the government to introduce purchasing and downpayment restrictions to slow soaring prices.

But when the crisis hit and the economy went into freefall, Beijing decided it had no choice but to refill the property bubble with a tidal wave of credit.

The result was an immediate rebound and an increase of total debt in the economy from about 140 per cent of gross domestic product at the end of 2008, to more than 250 per cent at the end of June.

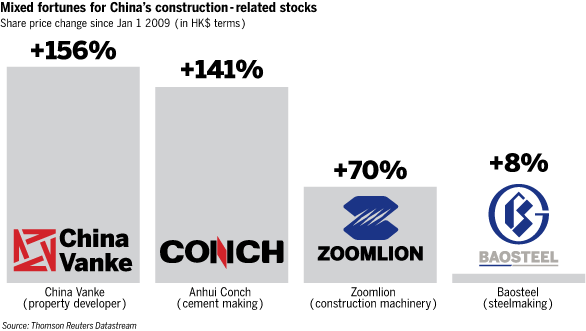

To understand the scale of the resulting building boom, consider this statistic: in just two years – 2011 and 2012 – China produced more cement than the US did in the entire 20th century.

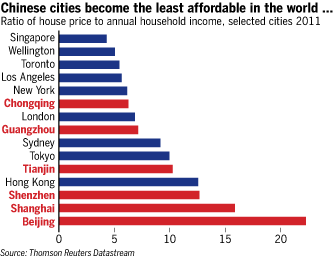

In the past decade much of China’s construction frenzy has been driven by real demand, from people wanting to urbanise or upgrade their homes or from speculators who have almost no other options to invest their newfound wealth.

China’s stock market has been in the doldrums since a massive bubble burst in 2007, returns on bank deposits are negligible or negative and the country’s capital controls mean citizens cannot easily diversify their portfolios abroad.

The government itself has an enormous incentive to keep pumping the bubble up, since all land is technically owned by the state and land sales made up 60 per cent of local government’s budgetary revenues last year, according to estimates from JPMorgan.

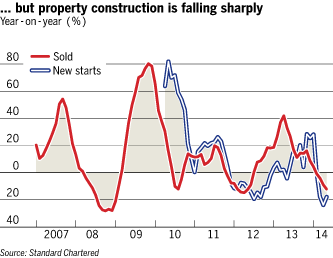

Since 2008 land prices have increased fivefold, triggering corresponding asset price rises, but even as prices soared and supply mushroomed, demand for housing and office space pretty much kept up – until this year.

Prices in 55 of China’s 70 largest cities fell in June from a month earlier, compared with just 35 cities in May, accelerating a downward trend that began at the start of the year and marking the sharpest monthly price decline since December 2008.

“China’s real estate market seems to have reached a turning point,” said Zhu Haibin, a JPMorgan economist, in a recent report. “A housing market slowdown is the major near-term macro risk in China.”

The turning point seems to have come because China has simply built too much.

Until 2011, the market mostly saw supply shortages but today total floor space under construction is enough to satisfy well over four years of demand at a national level.

In some of the worst affected provinces, there is enough supply for more than seven years of demand.

More than 90 per cent of households already own at least one home and, for those urban households that own apartments, nearly 76 per cent of their assets are in real estate, according to Gan Li, director of the Survey and Research Center for China Household Finance.

Mr Gan estimates that China’s existing housing stock is already more than sufficient for every household to own their home but developers are still supplying well over 15m new units a year.

Back in Yujiapu, construction on the skyscrapers has slowed to a crawl as ambitious government planners ponder the possibility that China’s real estate bubble has finally burst and their dream of Wall Street on the Tianjin salt flats will never become reality.

Comments